A Fair Tax and Revenue Plan for the District

The time is long overdue for Tax Justice for the Majority, and for wealthy DC residents paying their fair share of DC taxes, so essential programs are better funded in our Budget.

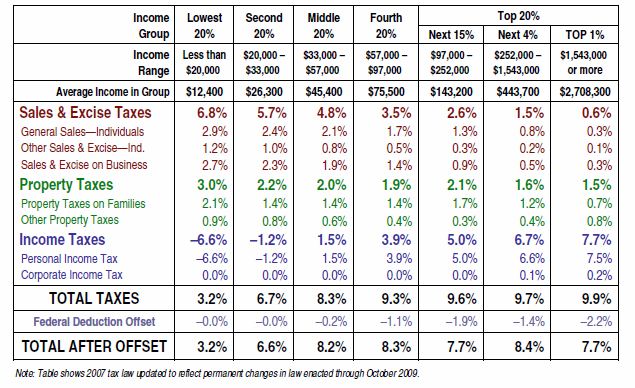

In our plan, most DC families would have more disposable income after paying their taxes. Examples of the benefit:

Families With: |

||||

| $12,400: | (annual income) would have | $372 |

more income than now | |

| $26,300: | $815 |

more income | ||

| $45,400: | $1,090 |

more income | ||

| $75,500: | $302 |

more income | ||

| Only the top 5%, with average annual income of $443,700 and above would pay more taxes. | ||||

Introduction

After spending District residents’ tax money on wasteful projects such as a baseball stadium for the multimillionaire owners of the city’s baseball team and handing out tax abatements and “sweetheart deals” to corporations like they were so much trick or treat candy, the District now faces a huge projected shortfall in revenue, estimated to over $500 million for the coming fiscal year. Like the Control Board era, there is a real danger that our budget will once again be balanced on the backs of low and middle-income residents. And this prospect comes on top of a $50 million cut in essential programs such as child care, disability support and job training that the Council and Mayor imposed on our present budget. The crisis of everyday living is now a reality for a majority of our residents whose incomes fall below self-sufficiency, meaning that many families go into debt just to survive the current recession, really a depression for low-income folk. Many residents must now choose where their inadequate income must go; will it be to meet the increasing cost of food, rent, utilities and/or medicine this month?

But there is an alternative to more hurtful budget cuts and the inadequate income support for many of our residents. The Council can and should pass new legislation in this session that would provide substantial tax relief to the bottom 60% income bracket of DC's families (with average incomes below $57K) while generating additional revenue that will help protect essential programs in our budget that serve our low income and working/middle class families and individuals. This plan will couple a hike in the top 5%, with tax relief for the majority of taxpayers and go far in meeting the challenge of the projected shortfall in revenue. Further it would create a long needed progressive structure for DC's individual/family taxes, contributing to a future sustainable revenue base for the future.

Moreover, our plan simultaneously addresses the ongoing hemorrhaging of our revenue to big developers and other corporate interests in the form of unjustified tax exemptions, abatements and subsidies. These giveaways include over $100 million in rent going to private facilities for municipal business instead of using renovated public space and $50 million for renovating seating for the VIP's at the Verizon Center.

The tax system and budget must be made fully transparent and accountable, making possible a detailed review of tax exemptions and abatements for commercial and non-profit properties. Taxpayers and elected officials must be able to evaluate the community benefits (if any) from these tax giveaways to big developers and other corporate interests.

Finally, according to the DC Fiscal Policy Institute “while 26 states have tapped their rainy day funds to close budget gaps during the current economic downturn — including Maryland and Virginia — the District has not used its $284 million in reserves to address the recession, ” because of Congressional restrictions on its use. DC’s rainy day fund should be used to address this and potential budget deficits in coming years! Since Congress makes these rules, our Delegate to the House Eleanor Holmes Norton should vigorously lobby to make this happen, and lead our community to make this demand on Congress now.

Further our Delegate should immediately submit a bill for DC Statehood, the only way we get two voting Senators plus one voting member of the House, and a permanent end to the potential veto by Congress of legislation and budgets passed by our local government. In other words, we would get the same rights as citizens of the 50 states by becoming the 51st state in the Union. And only DC Statehood will give us the opportunity to implement a tax on income earned by two thirds of the DC's workforce that live outside our jurisdiction by a fair and progressive reciprocal taxation approach.

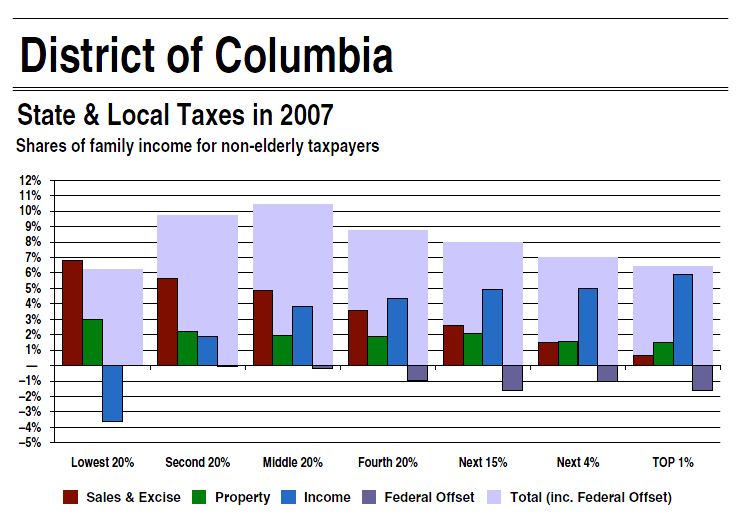

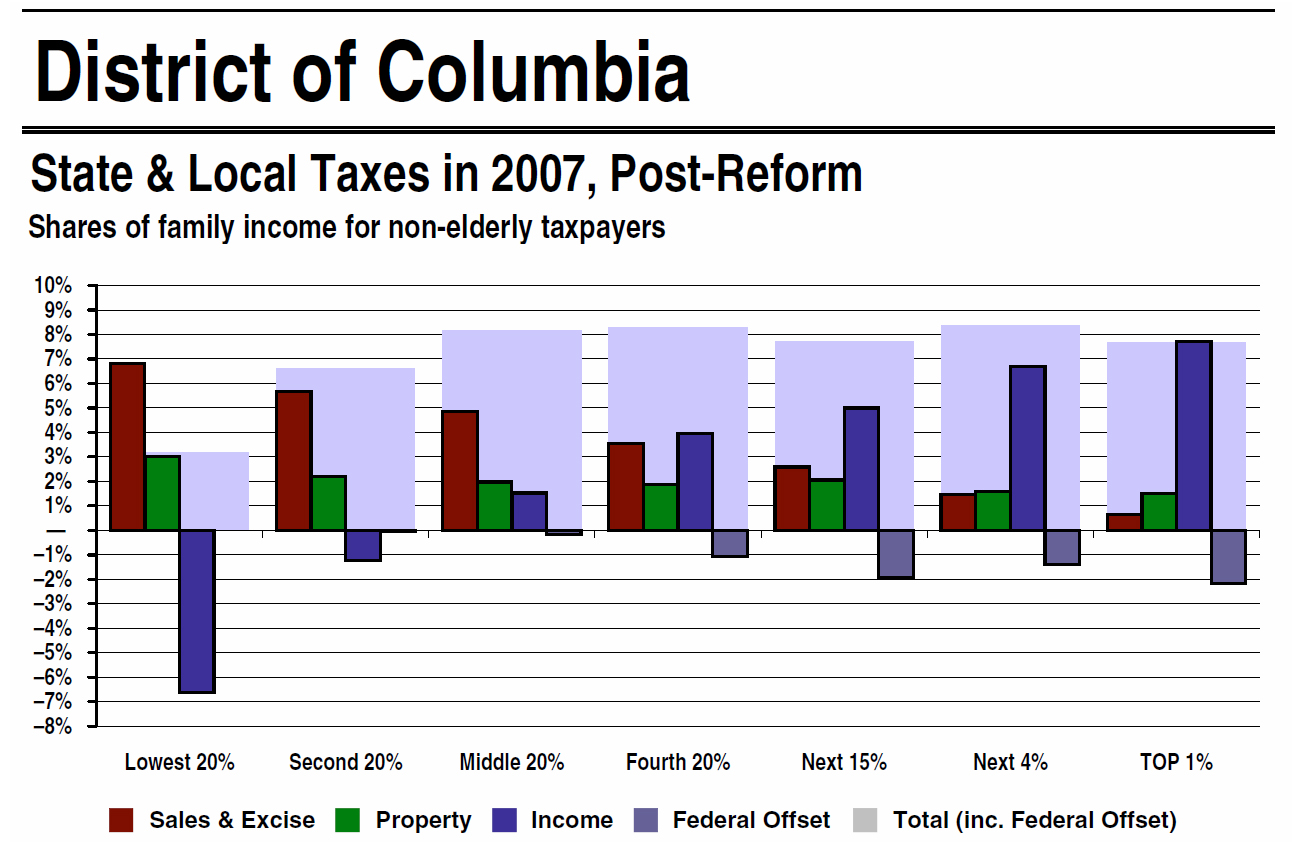

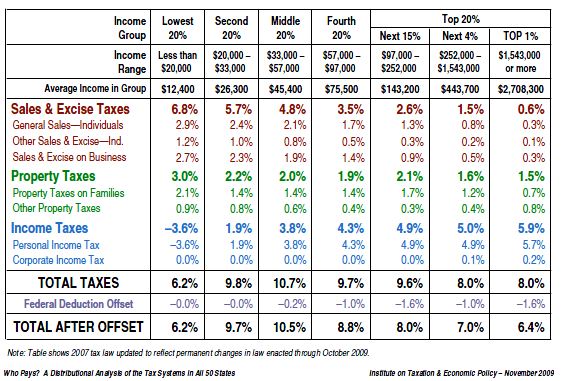

This plan was developed by Matt Gardner (ITEP economist) and David Schwartzman in December, 2009) Note the graphs showing the before (present structure) and after (reform plan outlined below.

Summary of Principal Objectives

1) Make the District’s tax structure for individuals and families fair, that is progressive, with tax rates increasing with income level for a given family size, so that the tax burden falls on those most able to bear it.

Note: The federal income tax structure is already progressive, but the District’s overall tax burden is regressive for most families; for incomes above $33K the tax rate steadily declines as incomes rise. District millionaires now pay a lower rate than all but the poorest families, averaging $12,400 a year (the federal poverty level in 2009 was $21,800 for a family of four, with the self sufficiency income being more than twice this level. A fairer tax structure will require giving needed tax relief to the low to middle income 80% of DC individuals and families while getting the best-off District residents paying their fair share of city taxes. Once the tax structure is made progressive, tax rates for all residents can be lowered once the District government is forced to stop the hemorrhaging of our revenue to big developers and other corporate interests.

2) Make the city’s tax system sustainable, that is insuring it can generate badly needed revenue targeted to funding essential programs, such as affordable housing and childcare, in the District budget for the next year and for the next decade.

3) Make the tax system and budget more transparent and accountable, by engaging in a detailed review of tax exemptions and abatements for commercial and non-profit properties. Taxpayers and elected officials must be able to evaluate the community benefits (if any) from these tax giveaways to big developers and other corporate interests.

The Specifics

1) Tax reform for DC's families

Package includes the following provisions:

a) Base the DC income tax structure on a flat percentage of the federal income tax payment using the pre-Bush federal tax structure, that is with the Bush tax cuts targeted for the wealthy removed, thereby simplifying the payment process and increasing fairness (see Tables below for a comparison). Keep the DC Earned Income Tax Credit.

b) Expand the Schedule H low-income property tax credit in the DC income tax schedule to make it available to middle-income families and individuals, by:

-Raising the income limit for eligibility from $20,000 to $70,000,

-Raising the maximum credit from $750 to $3,000.

c) Include a built-in deduction for sales/excise taxes (the most regressive part of the tax burden, which is having the most impact on low-income residents) directly into the DC income tax form, insuring an overall progressive structure for DC residents. Sales tax revenue from non-residents such as commuters and tourists would not be reduced, since they do not pay DC income tax.

Once implemented, the proposed DC Tax Structure would reduce income tax payments for most DC families and individuals.

d) Rather than going into the General Fund, revenue enhancements shall be targeted to underfunded essential programs in the DC Budget in consultation with Empower DC, Fair Budget Coalition, DC Jobs with Justice and other groups that truly serve the interests of the majority of our residents. This package is estimated to increase D.C. tax revenues by at least $116 million annually.

Assessing its impact on taxpayers: Compare our present tax structure to the “Post Reform (see graphs).

Note: once implemented the top 1% would receive an effective overall rate increase of 1.9% (after federal deduction offset only 1.3%) and the next 4% bracket a rate increase of 1.7% (after federal deduction offset only 1.4%). If the tax relief for the bottom 60% were reduced then of course the revenue generation would be greater.

2) Achieving transparency in tax abatements: Revise B18-0400 "Exemptions and Abatements Information Requirements Act of 2009" by strengthening the requirements for compliance with penalties.

3) Reform rainy-day-fund rules: The rainy day fund must be used to address potential future budget deficits! Since Congress makes these rules, our Delegate to the House Eleanor Holmes Norton should vigorously lobby to make this happen.

We also urge our residents to contact our Delegate urging her to immediately submit a bill for DC Statehood, which is the only way we get two voting Senators plus one voting Representative to the House, plus a permanent end to the potential veto by Congress of legislation and budgets passed by our local government. In other words, we would get the same rights as citizens of the 50 states by becoming the 51st state in the Union. Only DC Statehood will give us the opportunity to implement reciprocal taxation of income earned by two thirds of the DC's workforce that lives outside our jurisdiction.

If you want to join this campaign for Tax Justice for DC or for more information please email: dschwartzman@gmail.com or call: 202-829-9063

|

|

|

|

Federal Tax Brackets in 2011 Under "Pre-Bush Law |

||||||

Married Bracket |

||||||

From |

To |

Marginal Tax Rate |

DC rate at 48% of Federal |

|||

— |

58,200 |

15% |

7.2% |

|||

58,200 |

140,600 |

28% |

13.4% |

|||

140,600 |

214,250 |

31% |

14.9% |

|||

214,250 |

382,650 |

36% |

17.3% |

|||

382,650 |

and up |

39.60% |

19.0% |

|||

Note: The DC rate given above is the base before DC EITC, Schedule H and the Sales Tax rebates in our plan are applied.

In comparison, the 2009 Federal Income Tax Brackets and Marginal Rates for

Married individuals filing joint returns and surviving spouses

If Taxable Income Is: |

The Tax Is: |

Not over $16,700 |

10% of the taxable income |

Over $16,700 but not over $67,900 |

$1,670 plus 15% of the excess over $16,700 |

Over $67,900 but not over $137,050 |

$9,350 plus 25% of the excess over $67,900 |

Over $137,050 but not over $208,850 |

$26,637.50 plus 28% of the excess over $137,050 |

Over $208,850 but not over $372,950 |

$46,741.50 plus 33% of the excess over $208,850 |

Over $372,950 |

$100,894.50 plus 35% of the excess over $372,950 |

Posted 4/9/2010